Key Features of the Aise Platform

Connect your payroll and bill accounts, and Aise will automatically set aside the exact amount needed for each bill, ensuring timely payments and eliminating late fees.

Streamline Your Finances

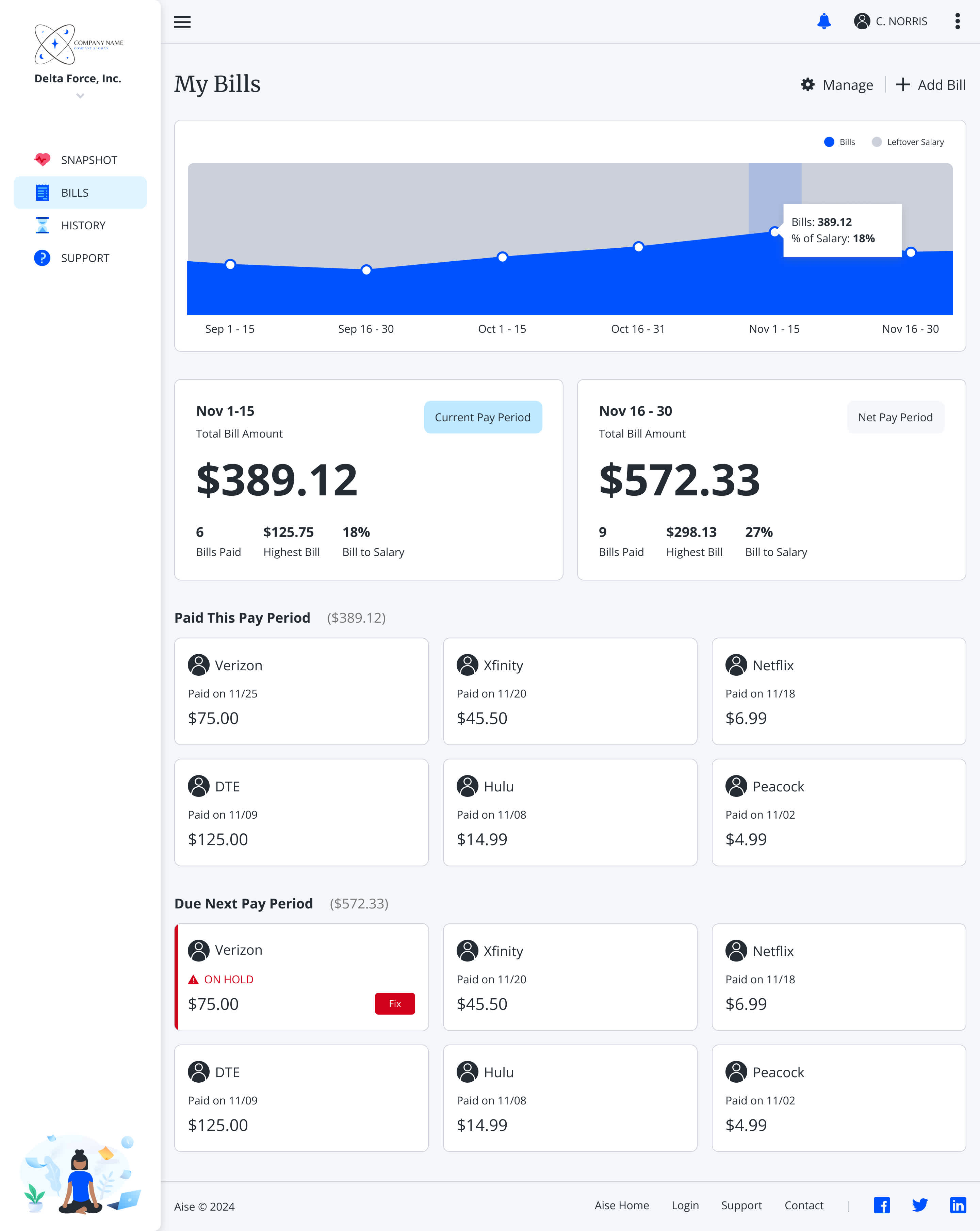

Automated Bill Pay: Connect your payroll and bill accounts, and Aise will automatically set aside the exact amount needed for each bill, ensuring timely payments and eliminating late fees.

Real-Time Financial Overview: Get a clear picture of your financial situation with real-time access to income, expenses, savings goals, and credit score.

Personalized Budgeting Tools: Create and track personalized budgets to gain control of your spending and reach your financial goals faster.

Savings Goals Tracking: Set savings targets for various milestones, like a down payment or a dream vacation, and track your progress with ease.

Build a Brighter Financial Future

Debt Management Tools: Develop a plan to tackle your debt and see your progress as you make payments.

Investment Guidance: Explore investment options and get personalized recommendations based on your risk tolerance and financial goals.

Financial Education Resources: Access a library of financial wellness tips, articles, and tools to enhance your financial literacy.

Credit Score Monitoring: Stay on top of your credit score with regular updates and insights on how to improve it.

A financially healthy workforce is a happier and more engaged workforce.

Providing Aise as a financial wellness benefit demonstrates your commitment to your employees' overall well-being.

Employer Benefits

Providing Aise as a financial wellness benefit demonstrates your commitment to your employees' overall well-being, and gives enhancement to employee wellness.

Financially secure employees are more focused and productive at work, driving an increased productivity for your entire team.

Attract and retain top talent by offering a valuable benefit that sets you apart.

Help employees avoid financial stress-related absences, saving your company time and money.

Key Benefits

Gain financial certainty and eliminate the stress of missed payments.

Make informed decisions and build a stronger financial future.

Focus on your work without financial worries weighing you down.

A financially healthy workforce is a happier and more engaged workforce.